✅ Summary of Key Developments:

🔷 Transaction Type: Share Subscription & Shareholders’ Agreement signed with Torrent Green Energy & its subsidiary, Torrent Urja 28 Pvt Ltd (TUPL).

📆 Date Signed: 12th May 2025

💼 Purpose: Meet criteria of a “captive user” under electricity laws; stake in 20 MW hybrid wind-solar plant in Gujarat.

📊 Arvind’s Investment: ₹21 crore for 15.96% equity in TUPL.

🟢 Project Objective: Use clean energy to power Arvind’s operations & meet carbon neutrality goals.

🧾 PPA Tenure: 25-year Power Purchase Agreement with Take-or-Pay structure.

⚡ Savings Estimate: Power at ₹5/unit with under 2-year investment payback.

📈 EBITDA Margin Boost: 30-40 basis points improvement expected by FY27.

🛠️ Execution: Torrent Green Energy to handle turnkey project execution & regulatory compliance.

🕒 Completion Timeline: Targeted for Q3 FY27 (within 17 months).

📝 In-Depth Report:

Arvind Limited, one of India’s leading textile-to-retail conglomerates, has made a significant strategic move to align its business operations with sustainable practices and its long-term carbon neutrality goals. In a noteworthy development dated 12th May 2025, the company disclosed under Regulation 30 of SEBI LODR that it has executed a Share Subscription and Shareholders’ Agreement with Torrent Green Energy Private Limited (Sponsor) and Torrent Urja 28 Private Limited (TUPL). This move signals Arvind’s intention to become a captive user under Indian electricity law by investing in a 20 MW hybrid (wind and solar) power project in the state of Gujarat.

Arvind Limited will acquire 15.96% of TUPL’s equity capital, amounting to an investment of up to ₹21 crores, as part of a broader 26% user-member stake required for captive user status. This renewable energy initiative is expected to supply nearly 60% of Arvind’s total electricity needs once the plant is commissioned. Notably, this power will be acquired at a landed cost of ₹5 per unit, which is significantly lower than grid prices, thus offering substantial cost savings and operational efficiency.

The agreement is structured to offer a strong financial return, with the payback period for Arvind’s investment estimated at less than two years. Moreover, the initiative is expected to boost the company’s consolidated EBITDA margin by 30-40 basis points by FY27, adding further financial appeal to this environmentally conscious investment.

The plant will be developed and managed entirely by Torrent Green Energy, which will be responsible for its erection, commissioning, operations, maintenance, and regulatory clearances. The timeline for the project is approximately 17 months, with commissioning targeted for Q3 FY27. The entire initiative reinforces Arvind’s broader environmental, social, and governance (ESG) goals and strengthens its positioning as a responsible and forward-thinking corporate entity.

From a business strategy perspective, this green investment aligns with Arvind’s diversified portfolio which spans textiles, advanced materials, apparel, telecom, and environmental solutions. By reducing its dependency on grid electricity and switching to renewable sources, Arvind is not only securing cost advantages but also reducing volatility associated with fluctuating energy tariffs.

This move will likely have a positive impact on Arvind’s share performance in the long term. Investors are increasingly favoring companies with strong ESG credentials. With this proactive step, Arvind sends a strong signal to the market about its seriousness toward carbon neutrality and energy self-reliance, both of which are increasingly valued by institutional investors and sustainability-focused funds.

For retail investors, this initiative represents a dual benefit. First, it showcases Arvind’s commitment to long-term profitability through cost optimization. Second, it bolsters the company’s ESG credentials, making it a more resilient and attractive investment option in a market where sustainability is fast becoming a key performance differentiator.

📈 Key Market Data (as of 12 May 2025)

-

🔹 BSE Code: 500101

-

🔹 NSE Symbol: ARVIND

-

🔹 Current Market Price (CMP): ₹385.05

-

🔹 52 Week Range: ₹271.55 – ₹450.40

-

🔹 Market Cap: ~₹10081.30 Cr

-

🔹 Sector: Textiles & Apparel – Renewable Energy Diversification

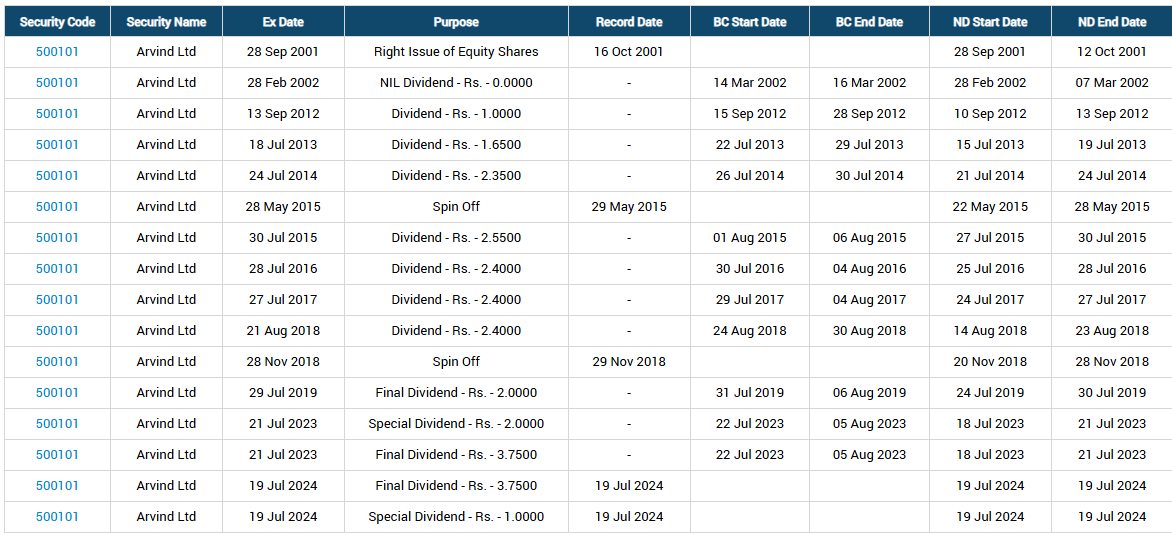

Dividend, Right issue, spin off, Special Dvividend

🧑💼 About the Company

Arvind Limited is a renowned name in the textile and retail space. Known for its innovation and sustainable practices, Arvind’s portfolio covers textiles, advanced materials, apparel retail, environmental solutions, telecom, and Omni-channel commerce. It is one of the world’s leading fabric manufacturers and has consistently leveraged technology and innovation to stay ahead of the curve. With this renewable energy initiative, Arvind reaffirms its identity as a company that not only creates fashion but also creates a better future.

💬 Phrase for User Engagement

👉 “Is your portfolio ready for a green future? Track how Arvind’s bold move could reshape the energy narrative for Indian corporates.”

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.