Indian stock market today| Sensex and Nifty today| Market closing report| FII and DII data| India market news October 2025| Nifty top gainers and losers| Sensex performance analysis| NSE BSE updates| Stock market outlook India| Indian share market forecast

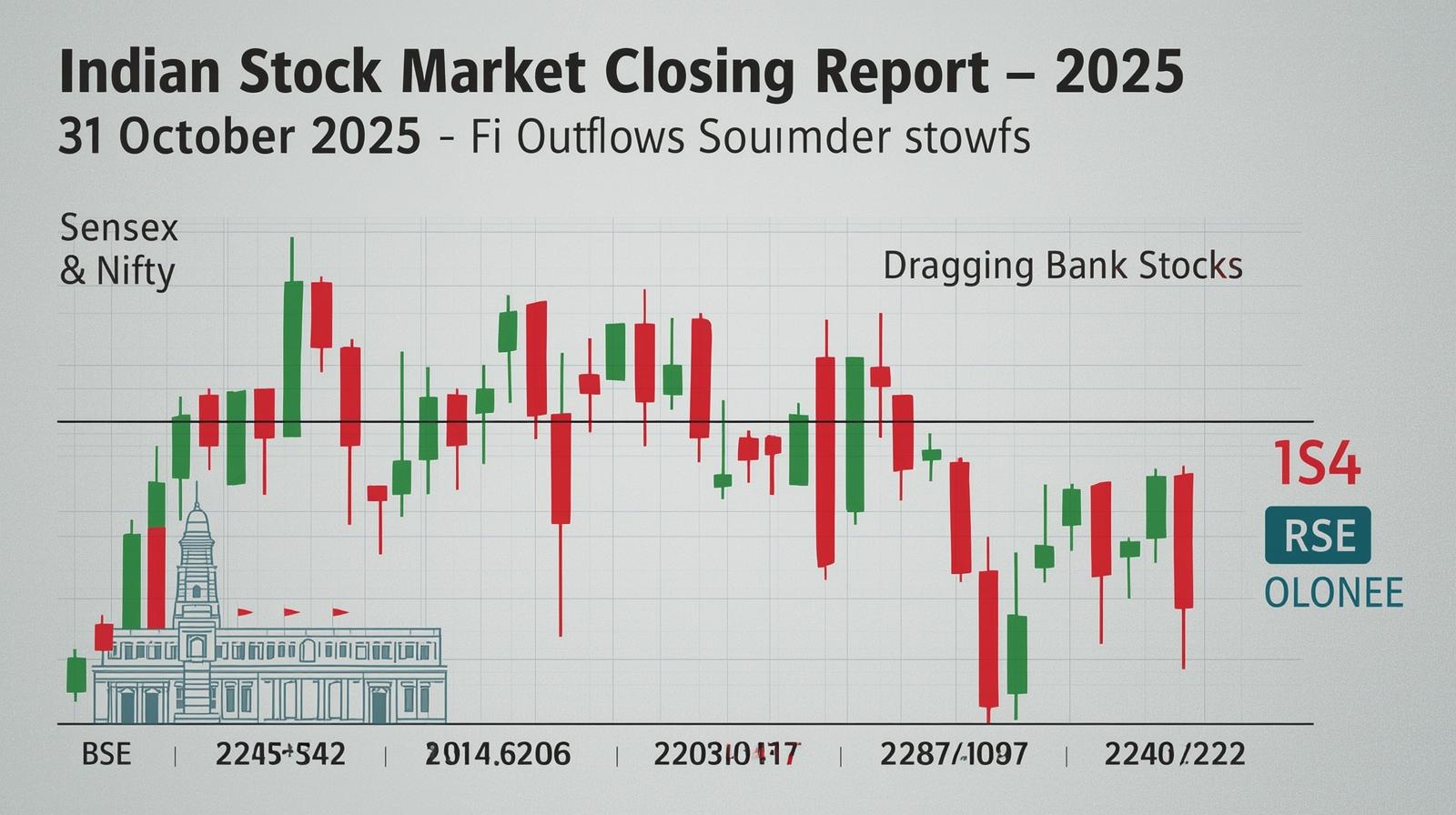

The Indian stock market closed lower on Friday, October 31 2025, weighed by weakness in private-sector banks, continued foreign institutional investor (FII) outflows, and soft global cues. Despite a strong start to the week, profit-booking dominated the final session of October as participants opted for caution ahead of the new month and macro data releases.

1️⃣ Market Highlights

- BSE Sensex: 83,938.71 (-465.8 pts / -0.55 %)

- NSE Nifty 50: 25,722.10 (-155.75 pts / -0.60 %)

- Market Breadth: Decliners outnumbered advancers by roughly 3:1

- Volatility Index (VIX): edged up nearly 2 % indicating nervousness

- Turnover: Moderate — led by banks, auto and energy stocks

Broader indices and mid-caps also softened, though the correction remained orderly without panic-selling.

2️⃣ Macro Backdrop and Global Cues

Global risk sentiment remained fragile. Overnight, US indices closed mixed ahead of key tech earnings and policy speeches. The US dollar index hovered near multi-week highs, pressuring emerging-market currencies including the INR. Crude prices continued their slide with Brent around $64 per barrel — a third consecutive monthly decline — helping India’s import bill but signalling sluggish global demand.

Asian markets were largely lower as well, following weak Chinese PMI figures. The combination of a strong dollar, rising bond yields and subdued commodity demand kept risk-assets under pressure.

3️⃣ Domestic Macro Snapshot

- USD/INR: 88.69 ( day high 88.76 )

- India 10-Year G-Sec Yield: 6.54 – 6.58 %

- Crude Oil: Brent ~ $64.3 / bbl

- FII Activity: Net outflow on 30 Oct ≈ ₹3,000 crore

- DII Activity: Net buyer ≈ ₹2,000 crore

The persistent FII selling streak has become a major drag for indices. Domestic institutions provided some support but could not fully offset the foreign outflows.

4️⃣ Sector Performance

🏦 Banking and Financials

Private banks led the decline. ICICI Bank, Kotak Mahindra Bank and Axis Bank shed 1–3 % each. Profit-booking after recent gains and concerns over margin compression hurt sentiment.

Public-sector banks, meanwhile, outperformed slightly as investors preferred balance-sheet stability and higher government visibility.

⚡ Energy & Commodities

Oil marketing companies and utilities held steady as lower crude reduces input costs. ONGC and Coal India were flat to positive. Metal stocks faced mild selling following weak Chinese data.

💻 Information Technology

IT stocks saw sideways moves. Infosys and TCS ended flat as investors await Q3 guidance on AI-driven demand. The INR weakness is a partial cushion for exporters.

🛒 FMCG and Consumer

Defensive buying in HUL and Nestlé India limited index losses. Rural demand remains steady as food inflation eases.

🚗 Automobile

Auto stocks witnessed mixed action ahead of monthly sales data. Maruti declined while Tata Motors ended positive on EV pipeline updates.

🏗️ Infra and Real Estate

High bond yields tempered gains for developers. Cement names were marginally lower amid cost concerns.

5️⃣ Top Gainers and Losers (Indicative)

Gainers: Power Grid Corp, NTPC, Coal India, Tata Power, Tech Mahindra

Losers: Kotak Mahindra Bank, ICICI Bank, HDFC Bank, Bajaj Finserv, Titan

The contrast underscores rotation toward defensive utilities and away from private financials.

6️⃣ FII & DII Flow Analysis

Foreign investors have been net sellers through most of October. Cumulative monthly outflow is estimated above ₹14,000 crore. Reasons include global yield differentials, US Fed’s tight stance, and portfolio rebalancing.

Domestic institutions (insurance funds, mutual funds) have countered with steady inflows driven by SIP subscriptions. However, in thin liquidity sessions, FII selling pressure still dominates index moves.

Important You also aware of these:

- Shreeji Global FMCG Ltd. IPO

- Lenskart Solutions Ltd. IPO

- Studds Accessories Ltd. IPO

- Orkla India Ltd. IPO

- Reliance Jio–Google Partnership: 18-Month Free Gemini Pro Access Set to Boost AI Adoption in India

- Top 5 Dividend Announcements in India: Infosys, HUL, Coal India, HCL Tech, and Sundram Fasteners Reward Shareholders

- Vodafone Skaylink acquisition Skaylink GmbH for €175 Million to Boost Cloud and AI Services

- Lesson 6: What is a Share? | Basics of Stock Market Course

7️⃣ Currency & Bond Market Update

The rupee’s depreciation near ₹88.70 reflects broad dollar strength rather than India-specific stress. Traders expect RBI intervention to curb excess volatility. Bond yields rose marginally as investors priced in higher borrowing supply for FY26.

8️⃣ Corporate Developments to Watch

- Earnings Season: Next week kicks off results from large IT and auto firms. Margins and commentary on rural demand will be key.

- M&A Buzz: Several mid-cap renewable players exploring strategic partnerships for capital infusion.

- Regulatory: RBI expected to release updated guidelines for digital lending platforms soon.

- Dividend Watch: Coal India and HCL Tech investors await interim dividend confirmation in early November.

9️⃣ Technical View on Indices

- Nifty Support: 25,650 – 25,700

- Nifty Resistance: 25,950 – 26,000

- Sensex Support: 83,800

- Sensex Resistance: 84,600

The pattern suggests a short-term consolidation phase. A close below 25,650 may invite further selling toward 25,400, while sustained trade above 26,000 could reignite momentum.

🔟 Outlook for Tomorrow (Nov 1 2025 Session)

Market tone remains cautious. If global futures stabilize and oil stays below $65, indices could see a technical rebound. Participants should monitor:

- Overnight US tech results impact on Nasdaq

- FII activity in first half of session

- Rupee movement versus USD

- Bank earnings and credit-growth updates

🌟 Top 5 Stocks to Watch Tomorrow

- ICICI Bank: Testing critical support zone; reversal possible if volume spike appears.

- Power Grid Corp: Defensive play with strong cash flows — watch for follow-through buying.

- Infosys: Rupee tailwind could boost export optimism.

- Coal India: Dividend expectation likely to keep sentiment positive.

- Tata Motors: EV news-flow and monthly sales numbers to drive volatility.

🔮 Medium-Term Market View

Despite short-term volatility, India remains structurally strong: robust domestic consumption, healthy banking system, and continuing infrastructure investment. Analysts expect FY26 earnings growth near 12–14 %. Valuations are rich but not excessive given India’s relative macro stability.

⚠️ Risks to Watch

- Renewed FII selling if global bond yields rise further.

- Any upside surprise in inflation data could spook bond and equity markets.

- Corporate earnings misses in banks or IT could trigger index pressure.

- Sharp currency volatility beyond ₹89 per USD may invite RBI action.

💡 Investment Takeaways

- Stick to quality large caps with strong cash flows.

- Use dips to accumulate defensive sectors like utilities and PSU banks.

- Traders can play short-term range with tight stop-losses.

- Long-term investors should stay invested in structural themes: renewables, digital transformation, EV ecosystem, and infrastructure development.

🧾 Conclusion

October 31 marked a cautious close for Indian equities. Sensex and Nifty slipped moderately as investors booked profits in banks and awaited fresh global signals. While FII outflows keep sentiment subdued, domestic fundamentals remain sound. If corporate earnings surprise positively and global yields stabilize, a renewed up-move cannot be ruled out in November.

For now, the market appears to be taking a healthy pause — a breather in a long-term uptrend that continues to favor India among emerging markets.

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)

-

Market Snapshot: Bulls Return on Global Cues & Trade Deal Optimism

Indian Stock Market| Nifty 50| Sensex| Bank Nifty| Axis Bank| India-EU FTA| Stock Market News| Market Wrap| Jan 27 2026…

-

India-EU FTA 2026: The “Mother of All Deals” Sealed – In-Depth Analysis

India EU FTA 2026| India EU Trade Deal| Tariff cuts India EU| CBAM India EU agreement| India EU Services Trade…

-

Hindustan Zinc OFS Review 2026: Vedanta to Offload ₹4,500 Cr Stake

Hindustan Zinc OFS Review| Vedanta Limited| HINDZINC| Stock Market News| Dividend Stocks| Silver Rally| Zinc Prices| Offer For Sale| High…

-

Weekly Market Intelligence: 10 Stocks to Watch

Top 10 Stocks| Top 10 Stocks to Watch| Market Analysis As the Indian markets navigate a period of heightened volatility…

-

Lesson 19 – KEY RATIOS |Deep Dive into PE, PB, ROE & DE

Key Ratios| Stock Market Basics| PE Ratio| PB Ratio| ROE| Debt Equity Ratio| Fundamental Analysis| Investing for Beginners Introduction| Part-1/3…